Crypto crime in 2021

As crypto gains in notoriety, so do its scams, scaring many potential crypto users away from the space.

Just this month we heard about two hacks of cross-chain DeFi protocols (Wormhole and QBridge), and just yesterday - OpenSea phishing attack.

As to the politicians accusing crypto of being a favourite tool of criminals and money launderers, it happens on a daily basis.

We believe that, like many other aspects of the crypto tech, its illicit use too needs to be demystified. A recent report by the on-chain analytics firm Chainalysis can shed more light on this obscure topic. We combed through its 140 pages to find that the situation is much better than presented by some (you can download the full version here).

Crypto crime overview

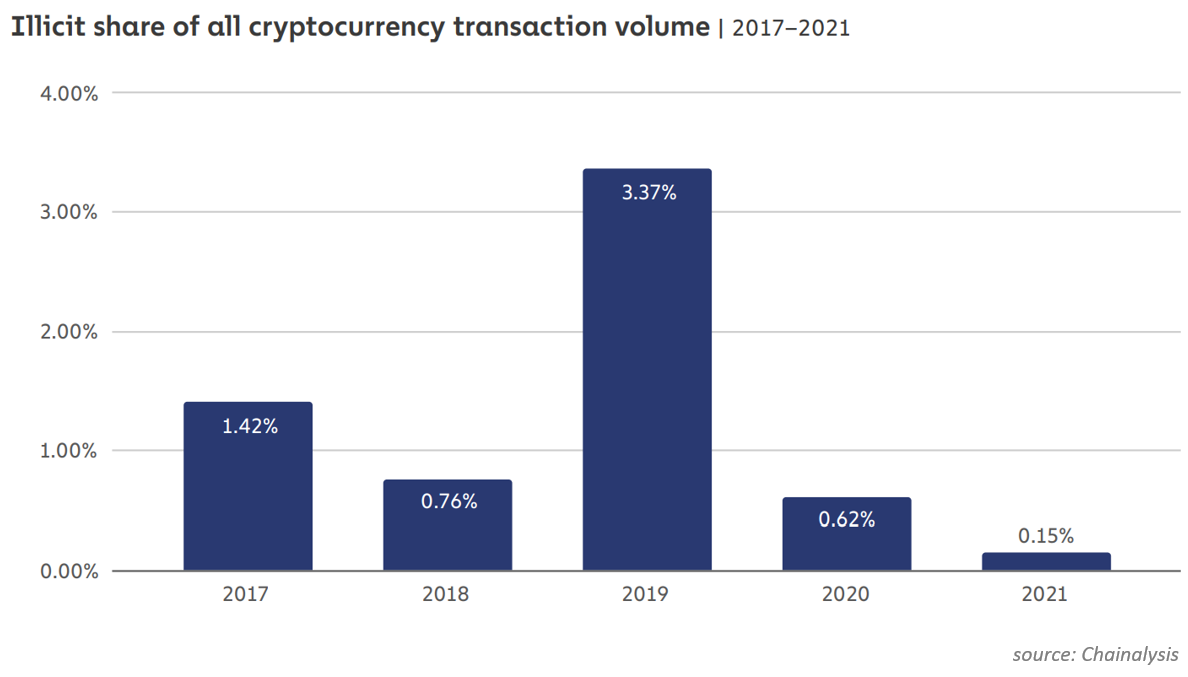

The share of transactions involving addresses Chainalysis identifies as illicit has fallen as low as 0.15%. Crime is becoming an increasingly smaller part of the ecosystem throughout the years (with the exception of 2019 that saw a big PlusToken Ponzi scheme).

In absolute terms crypto crime revenues have risen from $7.8Bn to $14Bn, which is not surprising, considering how tremendously crypto use grew in 2021: total crypto transaction volume amounted to $15.8Tr, up 567% from 2020. Moreover, the price of crypto itself has soared 3-6 times vs last year.

The most popular crypto crimes are scams, followed by stolen funds (resulting from hacks) and darknet markets activity

Crypto scams

Scams are the largest form of crypto-based crime by transaction volume, with over $7.7 Bn worth of crypto taken from the users.

2021 was marked by an increasing number of rug pulls – the projects where the founding team drains the project’s treasury or a liquidity pool funded by the users/investors and leaves. The biggest rug pull of 2021 was the Turkish centralized exchange Thodex, whose CEO left the country with over $2Bn worth of users’ cryptocurrency, which represents 90% of all value stolen in rug pulls this year. However, every other rug pull tracked by Chainalysis in 2021 involved DeFi projects, typically those, which code was not audited by any specialized security firm.

Another notable scam of the year was a Russian Ponzi scheme Finiko, which had operated for over a year and a half, before collapsing in July, liquidating over $1.1Bn of its user funds. Finiko head and his associate were arrested soon after.

The good news is that the average lifespan of a financial scam is getting shorter : from 192 days in 2020 to 70 days in 2021. One of the reasons for this could be their better investigation and prosecution, notably by the American CFTC, which charged 14 scams falsely claiming they were compliant.

Crypto hacks

First and foremost, despite newspapers regularly speaking of “blockchain hacks”, the blockchain itself is almost never involved. The blocks keep piling up, transactions are executed, smart contracts are running. It is the protocols built on the blockchain that are susceptible to exploits and scams, just like any software.

👨💻 In 2021 the number of crypto thefts increased significantly: $3.2 Bn vs last year’s $0.5 Bn, with a clear shift towards decentralized protocols ($2.3Bn). DeFi is booming, and hackers are scrutinizing its ever more numerous protocols for flaws, which they do not hesitate to exploit. Another popular type of attack is security breach, when hackers gain access to victim’s private keys.

Darknet markets

Darknet markets generated $2.1 Bn worth of crypto last year (16% increase vs last year), however successful law enforcement operations and self-closures lead to the number of darknet markets and fraud shops decreasing vs 2020.

For instance, less than a month before Joker’s Stash announced the fraud shop’s voluntary closure, the FBI and Interpol seized four of its blockchain domains—.bazar, .lib, .emc, and .coin. Later, in June, a multinational operation seized the infrastructure of Slil_PP, one of the largest fraud shops for stolen username-password combinations.

In October, the US Department of Justice announced the results of Dark HunTor, an operation that resulted in the arrest of 150 drug traffickers and the closure of two drug markets. Other darknet markets, such as DarkMarket, Monopoly, and CanadianHeadquarters, have shuttered after being caught in similar precarious situations this year.

Crypto for money laundering and terrorism financing

Blockchain is not a good tool for fiat money laundering: it is transparent, and from the moment law enforcement identifies a suspect, it is usually possible to trace their crypto dealings. Cash and siloed financial institutions are much better for money launderers: the UN Office of Drugs and Crime estimates that between $800 Bn and $2 Tr of fiat is laundered each year — as much as 5% of global GDP.

However, those who need to launder crypto resulting from crypto crimes do not have a choice and must invent ingenious methods of laundering it. In 2021 cybercriminals laundered $8.6 Bn worth of cryptocurrency: that’s a 30% increase vs 2020 (unsurprising given a huge growth in crypto activity and price). Still, crypto money laundering represents just 0.05% of all yearly crypto transaction volume.

Money laundering activity in crypto is also heavily concentrated. Most of illicit crypto it ends up at a small group of services, many of which appear purpose-built for money laundering based on their transaction histories. This concentration can help law enforcement to strike a huge blow against crypto-based crime, for example like last year’s US OFAC sanctioning two of the worst-offending money laundering services — Suex and Chatex.

When it comes to terrorism financing, crypto can also be useful in tracking it: in 2019 and 2020, al-Qaeda raised crypto through Telegram channels and Facebook groups. Thanks to the FBI, HSI, and IRS-CI, more than $1 million was seized from a payment provider who facilitated some of these transactions.

Combatting crypto crime

👩🏫 Most of the crypto criminals’ revenue now comes from scams, so warning and educating users can potentially reduce it by half. Centralized services could also play a role and, working with analytics firms and law enforcement, warn users not to send their funds to scammers’ addresses.

👮 Law enforcement’s ability to combat cryptocurrency-based crime is evolving, as shown by 2021 operations:

CFTC filed charges against 14 investment scams,

FBI took down REvil ransomware strain,

OFAC sanctioned of Suex and Chatex, two Russia-based crypto money launderers,

The U.S. Department of Justice (DOJ) seizing $2.3 million worth of cryptocurrency from the DarkSide ransomware operators responsible for the attack on Colonial Pipeline,

London’s Metropolitan Police Service made the UK’s largest ever seizure of crypto, taking £180 million worth from a suspected money launderer…

This month we saw another impressive crypto seizure: almost $4Bn worth of crypto hacked from the Bitfinex exchange in 2016.

Crypto is often accused of all sins – mostly because those who accuse it have a very poor idea of how it works. Blockchain being transparent, the flows of illicit crypto can be tracked, and law enforcement agencies all over the world prove they are learning how to do it.

What really needs to be done is raising people’s awareness about scams and rising the level of crypto literacy 🍎

We believe that a politician truly caring about their constituents should shift focus from trying to demonize crypto to helping people recognize fraudsters – just like with other kinds of telephone, email or web scams.

NFTs and Metaverse

Dapper Labs made a huge success of their NBA Top Shot series launched in 2020: the collection has been among top NFT series for many months, generating over $860M in all-time trading volume.

Now Dapper Labs is onto other sports. This January the company launched its UFC Strike NFT platform that offers fans memorable video moments of the Ultimate Fighting Championship in the form of NFTs.

The initial drop of 100k packs ($50 each) was sold out in a metter of hours, showing how fast sports fans could increase crypto users’ crowd: Dapper Labs co-founder Mik Naayem estimates that 80% of UFC Strike collectors are new to Flow, the blockchain they are issued on.

Next Dapper Labs target will be American football, with NFL All Day platform already launched in beta.

Markets

Bitcoin

This week Bitcoin price has lost its hold over the $40k threshold and went down 12% to $39k. It is not an isolated phenomenon: most markets are now subject to macro fears of the Fed increasing interest rates in March, as well as the possibility of an escalating conflict at the Ukrainian border.

Good news is that Bitcoin shows solid basis: not only its hashrate hit its all-time high this week, most long-term investors do not intend to spend their coins.

Ethereum

Ethereum price has lost 14% since the beginning of last week, bouncing off $2’580 to the current level of $2’730.

Quote of the week

"OK boomers ... You have zero jurisdiction on a sovereign and independent nation. We are not your colony, your back yard or your front yard. Stay out of our internal affairs. Don't try to control something you can't control."

Nayib Bukele, President of El Salvador, on the US Senators trying to assimilate all El-Salvador-related value flows to money laundering - because of its Bitcoin law

I was a victim of a fake broker where I lost a huge chunk of my life savings however after weeks of being depressed I met Bestcryptohacker who rescued me and recovered my stolen assets completely. Lookup this team now!!!

Have you been scammed through crypto theft through fake crypto investment schemes or faux broker? Send a detailed mail to Bestcryptohacker at Gmai| c0m for an amazing assistance